![]()

surely Cameron must go and followed quickly by Gidiot ..

![]()

surely Cameron must go and followed quickly by Gidiot ..

Replies sorted oldest to newest

velvet donkey posted:If Boris gets in, and it's no really a big if, I'll play the Boomtown Rats' Banana Republic on loop Dame Judy

surely is Velvet ![]()

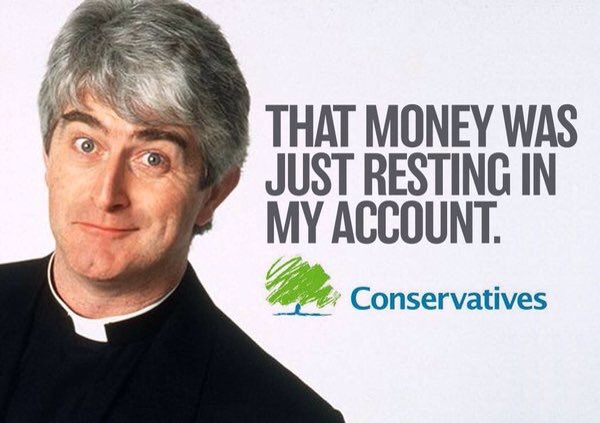

His dad didn't set it up to avoid tax ...it's like some bad comedy show ![]() He's not saying where his dad's money is now

He's not saying where his dad's money is now ![]()

velvet donkey posted:Pink Floyd's Us and Them always sums it up for me

![]()

![]()

anyone with one eye can see they are corrupt to the core and they are so transparent with their plans, my disgust for these people holds no bounds Velvet.

velvet donkey posted:I can see where you're coming from

Having said that I just got my tax rebate in from Bermuda.

![]()

![]()

![]()

Dame_Ann_Average posted:velvet donkey posted:If Boris gets in, and it's no really a big if, I'll play the Boomtown Rats' Banana Republic on loop Dame Judy

surely is Velvet

His dad didn't set it up to avoid tax ...it's like some bad comedy show

He's not saying where his dad's money is now

If he can be certain enough that it wasn't to avoid tax, why can't he just tell us what it WAS set up for?

Extremely Fluffy Fluffy Thing posted:If he can be certain enough that it wasn't to avoid tax, why can't he just tell us what it WAS set up for?

more lies and where is the rest of it Fluffs ![]()

Dame_Ann_Average posted:Extremely Fluffy Fluffy Thing posted:If he can be certain enough that it wasn't to avoid tax, why can't he just tell us what it WAS set up for?

more lies and where is the rest of it Fluffs

Well don't look at me! ![]()

Extremely Fluffy Fluffy Thing posted:Well don't look at me!

![]()

nor me..I'm just a pleb..an honest one though unlike our PM ![]()

velvet donkey posted:He's awfully quiet on this one. This one that is knocking on his door.

Hi Fluffs

he seems to have forgotten how many properties he owns...the blokes an idiot ![]()

![]()

![]()

" He and his family will not be benefitting in the future"

Are they really that stupid as to think we'll believe that. And also take it as read that they've NEVER benefitted in any way ......... EVER?

Hi Velvet. ![]()

Yeah, we could get Boris, which makes me despair of this country. I really can't stand him - he's incredibly unfit for the office of PM.

He's the epitome of amoral self service and self entitlement. He makes Cameron look like a beacon of integrity - which he obviously isn't.

Cameron says: 'It (off-shore fund) was subject to all UK taxes'.

Which does not necessarily mean it actually paid any!

How dare he have called it 'Blairmore Holdings'! Blairmore is where my grandparents (maternal) lived.

Extremely Fluffy Fluffy Thing posted:How dare he have called it 'Blairmore Holdings'! Blairmore is where my grandparents (maternal) lived.

Ian Cameron was born in Blairmore House and was a descandant of Alexander Geddes who built it.

Wiki link

Gosh that investigating fraud / tax evasion statistic tells you something... ![]()

Extremely Fluffy Fluffy Thing posted:How dare he have called it 'Blairmore Holdings'! Blairmore is where my grandparents (maternal) lived.

Really Fluffy? ![]() Jeez, one more reason [ if it was needed ] to make your blood boil!!!

Jeez, one more reason [ if it was needed ] to make your blood boil!!! ![]()

Dameee, if Boris gets in I shall start calling you *Dame Celia Molestrangler* ![]()

Anyone know who she is, without googling? ![]()

I only know because I came across reruns on the radio several weeks ago ![]()

Dame_Ann_Average posted:velvet donkey posted:Pink Floyd's Us and Them always sums it up for me

anyone with one eye can see they are corrupt to the core and they are so transparent with their plans, my disgust for these people holds no bounds Velvet.

![]() Me too!

Me too!

Extremely Fluffy Fluffy Thing posted:Dame_Ann_Average posted:velvet donkey posted:If Boris gets in, and it's no really a big if, I'll play the Boomtown Rats' Banana Republic on loop Dame Judy

surely is Velvet

His dad didn't set it up to avoid tax ...it's like some bad comedy show

He's not saying where his dad's money is now

If he can be certain enough that it wasn't to avoid tax, why can't he just tell us what it WAS set up for?

And he'll not be the only one ![]()

Moonie posted:Dameee, if Boris gets in I shall start calling you *Dame Celia Molestrangler*

Anyone know who she is, without googling?

I only know because I came across reruns on the radio several weeks ago

![]()

This, from Mark Steel in the Indie, is worth a read

http://www.independent.co.uk/v...-round-a6973161.html

I especially liked this bit:

"It’s touching to see our Prime Minister defend his father, even after admitting he had, in fact, benefited from his income. Hopefully if Jeremy Corbyn asks him any questions about him, Cameron will reply: “I’ll tell you what my father would have said – ‘do your tie up, sing the National Anthem, and spirit millions of quid away in the Bahamas so none of it gets taken and used for frivolities like treating cancer’.”

I do love a bit of satire, me

"

Anyone who thinks Boris is a harmless buffoon and that life in Britain would be a bit of a laugh under his leadership will be in for a shock. A very nasty shock

Madame Arcati posted:This, from Mark Steel in the Indie, is worth a read

http://www.independent.co.uk/v...-round-a6973161.html

I especially liked this bit:

"It’s touching to see our Prime Minister defend his father, even after admitting he had, in fact, benefited from his income. Hopefully if Jeremy Corbyn asks him any questions about him, Cameron will reply: “I’ll tell you what my father would have said – ‘do your tie up, sing the National Anthem, and spirit millions of quid away in the Bahamas so none of it gets taken and used for frivolities like treating cancer’.”

I do love a bit of satire, me

"

![]() Bliddy well said !

Bliddy well said !

I've JUST READ THIS...... http://www.theguardian.com/pol...jersey-panama-Geneva

www.theguardian.com › Politics › David Cameron

Extremely Fluffy Fluffy Thing posted:I've JUST READ THIS...... http://www.theguardian.com/pol...jersey-panama-Geneva

The page has been removed Fluffs ![]()

Yep, but..... Offshore venture in tax haven – named after family home in Aberdeenshire – valued at £25m.

At the heart of a stunning 50-acre estate by the banks of the river Deveron in Aberdeenshire sits the granite-clad Victorian mansion Blairmore House, home to four generations of the prime minister's family.

Built in the 1880s by Alex Geddes, a Scotsman who became known as the Chicago grain king, the estate holds decades of David Cameron's family history. The union of the Geddes and Cameron families was celebrated in the grounds in 1905, and the nearby chapel remembers forebears killed in the first world war. David's father, Ian Donald Cameron, was born in 1932 at Blairmore House. But soon after that, the old place was sold.

So it was perhaps for sentimental reasons that the offshore fund Ian Cameron helped to establish in the tax haven of Panama shares the name. Blairmore Holdings Inc, just like Blairmore House, is a monument to wealth obtained overseas.

Valued today at £25m, the Panamanian fund was established in 1982 while David was still at Eton, the school that his father attended. At the time, Ian Cameron still worked at Panmure Gordon, the City broking firm at which three generations of the family were senior partners.

The family's banking history goes back even further, to the 1860s, when Sir Ewen Cameron joined the industry. He later helped the Rothschild banking dynasty sell war bonds during the Russo-Japanese war. While at Panmure Gordon, Ian was a bond specialist too, showing determination to overcome his physical disability – he was born with deformed legs – and make partner at the firm by the age of 30.

What little we know of the historic activities of Blairmore Holdings comes from a shareholders' prospectus issued in 2006, less than a year after David Cameron became leader of the opposition.

The prospectus, designed to attract investors with a licence to take risks, notes that Ian Cameron, a director of the company, "was instrumental in the formation of Blairmore Holdings Inc" and explains that the fund is designed to "provide investors with steady long-term capital growth over and above the global rate of inflation".

It states: "The affairs of the fund should be managed and conducted so that it does not become resident in the United Kingdom for UK taxation purposes."

Explaining that the firm has access to banking services in Panama as well as auditors and trading offices in the Bahamas, Blairmore Holdings was certainly keen to convince investors that the business would be beyond the reach of Her Majesty's Revenue & Customs.

In recent months, the role of Britain's tax inspectors has come under renewed scrutiny. On Wednesday, David Cameron raised the subject again, telling parliament: "We have increased staffing at HMRC to ensure that we crack down on tax avoidance."

He then put pressure on the opposition to condemn Ken Livingstone for his tax affairs: "The man whom they are putting forward to be mayor of London has set up a company to funnel all this money into and is potentially paying a lower tax rate than the people who would work for him at the GLA. It is completely disgraceful."

There is no suggestion that Ian Cameron used his Panamanian investment fund to evade income tax, but the political debate around tax avoidance so far has focused only on individuals – not businesses like Blairmore that operate outside the tax jurisdiction of the largest world economies.

Before his death in 2010, Ian Cameron was intimately involved in several such companies: Blairmore Holdings, located in Panama; Blairmore Asset Management, a short-lived fund located in Geneva; and Close International, a Jersey-based investment vehicle founded in 1979. Of the countries in which the businesses were based, only Jersey has acceded to the requirements of the OECD global transparency tax standard.

All three businesses were operated by a clutch of British directors, who followed Ian Cameron from Panmure Gordon to Smith & Williamson, and who also found their clients among the British establishment.

Both Close International and Blairmore Holdings are listed in accounts of a clutch of Church of England charities and family trusts whose funds are managed by Smith & Williamson, among them an "educational charity" managed on behalf of Conservative peer Lord Vinson which donated to right-leaning thinktanks.

Of the three firms in which the prime minister's father was involved, Blairmore Holdings appears to be the largest and most successful. For his role as senior director, Ian Cameron was paid $20,000 (£12,400) a year. Due to the opaque nature of Panama's company records, it is impossible to know the full extent of his earnings from the fund, the size of his shareholding or what happened to the shares after his death.

What is certain is that the prime minister, who once described himself as the "heir to Blair", was not the heir to Blairmore.

On his father's death in October 2010, David Cameron inherited £300,000 in cash – just under the inheritance tax threshold at that time – while his two sisters split the proceeds of Ian Cameron's £1m Kensington mews house between them. In 2006, his elder brother, Alexander, a QC, moved into the £2.5m family home in Berkshire while the prime minister's parents downsized to the cottage next door.

In total, Ian Cameron left an estate of £2.7m but, under normal probate law, if there were assets outside England and Wales they would have to be administered in the territories in which they are registered. This leaves questions about the extent of Ian Cameron's offshore investments unanswered by the will.

Blairmore Holdings, meanwhile, continues to go from strength to strength. According to the company's own listing with the Financial Times, the value of the fund's investments has increased by 8.5% in the last three years.

The Blairmore legacy Ian Cameron left is unlike that of his forebears – it's not in the rolling hills of Scotland, but in a glass and steel office block in Panama City.

Additional reporting by John Burn-Murdoch

• This article was amended on 24 April 2012. The original said the family's banking history went back to the 1860s, when Sir Ewen Cameron helped the Rothschild banking dynasty sell war bonds during the Russo-Japanese war. He joined the banking industry in the 1860s and helped sell war bonds after the Russo-Japanese war began in 1904. This has been corrected.

Fluffy, a query on your Gaurdian article. In it it says :

"On his father's death in October 2010, David Cameron inherited £300,000 in cash – just under the inheritance tax threshold at that time – while his two sisters split the proceeds of Ian Cameron's £1m Kensington mews house between them."

Do you know why the bit about "just under the inheritance tax threshold" was included in that sentence? I thought the threshold was for the whole of the deceased's estate rather than per beneficiary.

El Loro posted:Fluffy, a query on your Gaurdian article. In it it says :

"On his father's death in October 2010, David Cameron inherited £300,000 in cash – just under the inheritance tax threshold at that time – while his two sisters split the proceeds of Ian Cameron's £1m Kensington mews house between them."

Do you know why the bit about "just under the inheritance tax threshold" was included in that sentence? I thought the threshold was for the whole of the deceased's estate rather than per beneficiary.

Good point El ![]()

El Loro posted:Fluffy, a query on your Gaurdian article. In it it says :

"On his father's death in October 2010, David Cameron inherited £300,000 in cash – just under the inheritance tax threshold at that time – while his two sisters split the proceeds of Ian Cameron's £1m Kensington mews house between them."

Do you know why the bit about "just under the inheritance tax threshold" was included in that sentence? I thought the threshold was for the whole of the deceased's estate rather than per beneficiary.

Hmm.......hadn't thought about it, but yes, it's what the whole estate is worth, It is paid from the value of the estate before WHAT'S LEFT is split up. If there is any tax due and there is not enough hard cash available to pay it, then some assets would have to be sold in order to get the cash needed.

Thinking now on that paragraph it comes across as an attempt to pull the wool over the eyes of those who don't know how inheritance tax works. So the question of proper tax having been paid or not paid on his father's estate remains.

It is also possibly not widely known that there are differences between how it works in Scotland and the rest of the UK.

Extremely Fluffy Fluffy Thing posted:El Loro posted:Fluffy, a query on your Gaurdian article. In it it says :

"On his father's death in October 2010, David Cameron inherited £300,000 in cash – just under the inheritance tax threshold at that time – while his two sisters split the proceeds of Ian Cameron's £1m Kensington mews house between them."

Do you know why the bit about "just under the inheritance tax threshold" was included in that sentence? I thought the threshold was for the whole of the deceased's estate rather than per beneficiary.

Hmm.......hadn't thought about it, but yes, it's what the whole estate is worth, It is paid from the value of the estate before WHAT'S LEFT is split up. If there is any tax due and there is not enough hard cash available to pay it, then some assets would have to be sold in order to get the cash needed.

Thinking now on that paragraph it comes across as an attempt to pull the wool over the eyes of those who don't know how inheritance tax works. So the question of proper tax having been paid or not paid on his father's estate remains.

It is also possibly not widely known that there are differences between how it works in Scotland and the rest of the UK.

I had a feeling that may be the case Fluffs ![]()

this is how he supposedly avoided inheritance tax...

http://www.guillaumes.com/news...ritance-tax-bill.htm

The will left by Prime Minister David Cameron’s father has highlighted the value of inheritance tax planning.

According to newspaper reports, Ian Cameron, who died last September, left an estate valued at just under £2.7 million.

He left £300,000 to the PM – just below the level at which inheritance tax is payable at 40 per cent – and passed on a £1.2 million property to his two daughters, Tania and Clare, via a trust, with the rest of his estate transferred to his wife Mary, who will not pay tax because of the way inheritance tax laws provide for spouses.

Mr Cameron Senior passed on the £2.5 million family home to his eldest son, Alex, in 2006, who received nothing in the will. Although the value of assets given away within seven years of death is added to the estate of the person making the gift, reports suggest this may not apply in this case as Mr Cameron had swapped houses with his son.

Neil Sapsed, a partner at Guillaumes specialising in wills, said: “Although most of us are not fortunate to have such large estates as Mr Cameron, this case does highlight just how important good inheritance tax planning will be.

“The assets held by Mrs Cameron now will be subject to inheritance tax on her death but it is likely that careful tax planning will also apply to her estate.

“Forward planning now can make a significant difference in preserving the value of an estate, which is why it is worth seeking the advice of solicitors expert in wills and estate planning.”

Jonathan Pie nails it ![]()

BBC news page, nothing happening..move along now

Back in the the real world

News that Cameron will be publishing the information that goes in his tax return for this year and previous years. I assume that when he says this year he means the one for the year ended 5 April 2015 which was due by this January.

The information is likely to be examined very closely by the media. Dividend income is shown on the tax return as a total figure and I would not expect it to be listed by company as that detail does not go on tax returns. Foreign dividends which total not more than £300 are shown in total. If the total exceeds £300 then they go on the foreign income pages of the return and are analysed by country, not by company. Each country has a three letter code and the code for Panama is PAN.

Capital gains have to be reported if, in a tax year, the total gains exceed the annual capital gains tax allowance (£10,100 in 2009/10) or if the proceeds exceed 4 times tha annual capital gains tax allowance.

Details of capital disposals have to be attached to the tax return showing a description of the asset sold, when sold, for how much and what the gain was.

If the only shareholding sold in 2009/10 was the Blaimore one then as his 50% share (his wife had the other 50%) was under the threshold it will not be shown on the tax return. That is the legal requirement and if there is no mention of the sale that would be correct and would not be a cover up.

However if there are other capital disposals in 2009/10 then that's a different matter and it should be shown. Cameron has indicated that he sold all his shares prior to becoming prime minister. He became prime minister in May 2010 so it's possible that there are other disposals in the 2010/11 tax return rather than the 2009/10 one. Note that if he had any holdings in share ISAs which he sold, those are tax free and do not go on tax returns.

Re Dame's post on Ian Cameron's estate and inheritance tax and the reference to the £1.2 milion property going to his daughters via a trust. there are complex tax rules relating to trusts.

Without knowing what type of trust it is and what the terms of it are we cannot say what tax was payable, or what tax will become payable in future.

Trust income tax rates can be as high as 45%:

https://www.gov.uk/trusts-taxes/trusts-and-income-tax

Dame_Ann_Average posted:

Jonathan Pie nails it

![]()

Dame_Ann_Average posted:BBC news page, nothing happening..move along now

Back in the the real world

KEY EVENTS SO FAR

- Protesters back at Downing Street

- They arrive at the Tory Spring Conference

- Protesters begin to march up the Strand

- "It has not been a great week"

![]()

Access to this requires a premium membership.

Upgrade to VIP premium membership for just $25/year to unlock these benefits:

| Ad-Free | Search Site | Start Dialogs |

| Upload Photos | Upload Videos | Upload Audio |

| Upload Documents | Use Signature | Block Members |

| View Member Directory | Mark All Topics As Read | Edit Posts Anytime |

| Post To Walls |